Tax UPDATES

FOr any Kind Of queries Feel freE to contact us!

WHICH ITR FORM RIGHT TO FILE

Heads of Income Categories of Person

- Salary Income Individual

- Income from House property HUF

- Capital Gain AOP

- Income from other source BOI

- PGBP AJP

FIRMS

LLP

COMPANY

TRUST

ITR-1 Sahaj

- Resident Individuals

- Income from Salary/Pension

- Income from one house property

- Income from other sources [Intt income, dividend income

- FD intt, Pension Income excluding special Income]

- Agricultural Income upto 5000 ₹

Total Income upto 50 lakh

ITR-2

- Resident & non- Resident Individuals & HUF

- Income from Salary/Pension

- Income above 50 L

- Income from other sources :- Intt income, Div income including special income

- Capital Gain (only STCL & LTCL No Intraday F & O income

- Agricultural Income More than 5000 ₹

- Director of Co.

- Holding Unlisted shares of Co

- Foreign Assets/ Foreign Income

- Clubbing Income

ITR-3

- This is all rounder Form

- It is wide form

- Income from all five heads of home

- Applicable to Resident & Non Resident Individuals & HUF

- Director of Co.

- Partner in a Form

- If Books & Accounts are Audited

- Carry forward & brought forward Losses

ITR-4 (Sugam)

- Applicable to Resident Individual, HUF and Firm (not LLP)

- Not applicable to NRI

- Small business person/professional / Freelancer opting presumptive taxation u/s 44AD /44ADA/44AE

- Income only upto 50 Lakh

- Income from salary / one house property

- Income from other sources

- No Capital Gain

ITR-5 ITR-6 ITR-7

AOP Companies Charitable & Religion trust

BOI Private Ltd Political Parties

AJP Public Ltd Research Institution

FIRM OPC Colleges / Universities

LLP

Business trust

Investment fund

Latest Tax Insights by CA Anita Agarwal

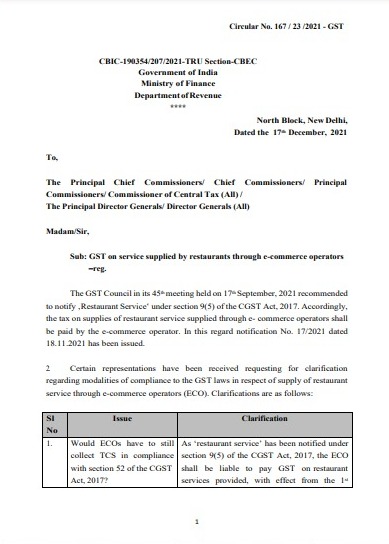

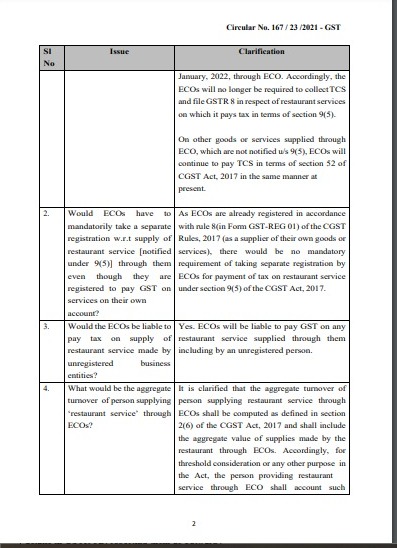

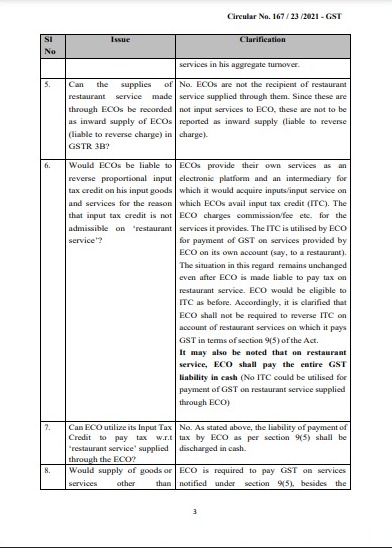

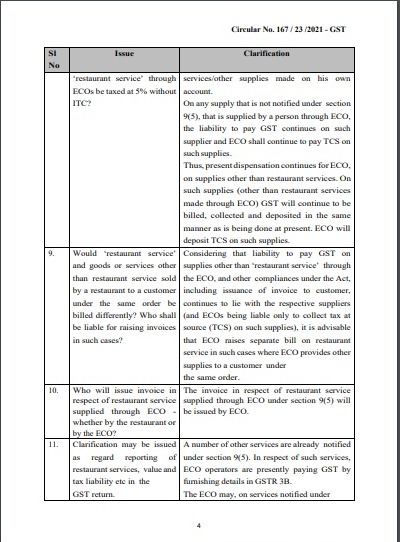

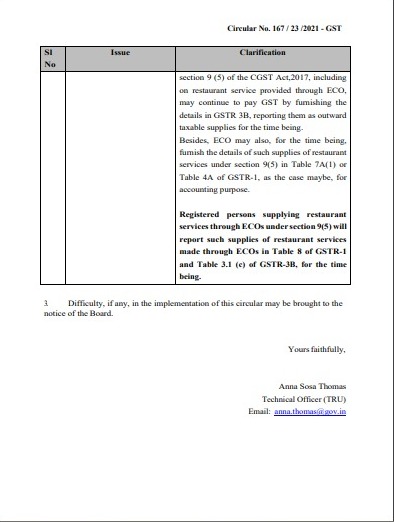

(Circular No. 167 / 23 /2021 - GST)

SAP TAX HUB

SAP TAX HUB is a Chartered Accountancy firm catering to Domestic as well as international clients. We are a CA firm in Delhi, We have been providing advisory, regulatory and compliance related services.

Useful Links

Get In Touch

- 226 ,Vardhman Premium Mall, Deepali Enclave Pitampura Delhi-110034

- Caanitaagrawal7@gmail. Com

- 7011951197

- 7011951197